Overview

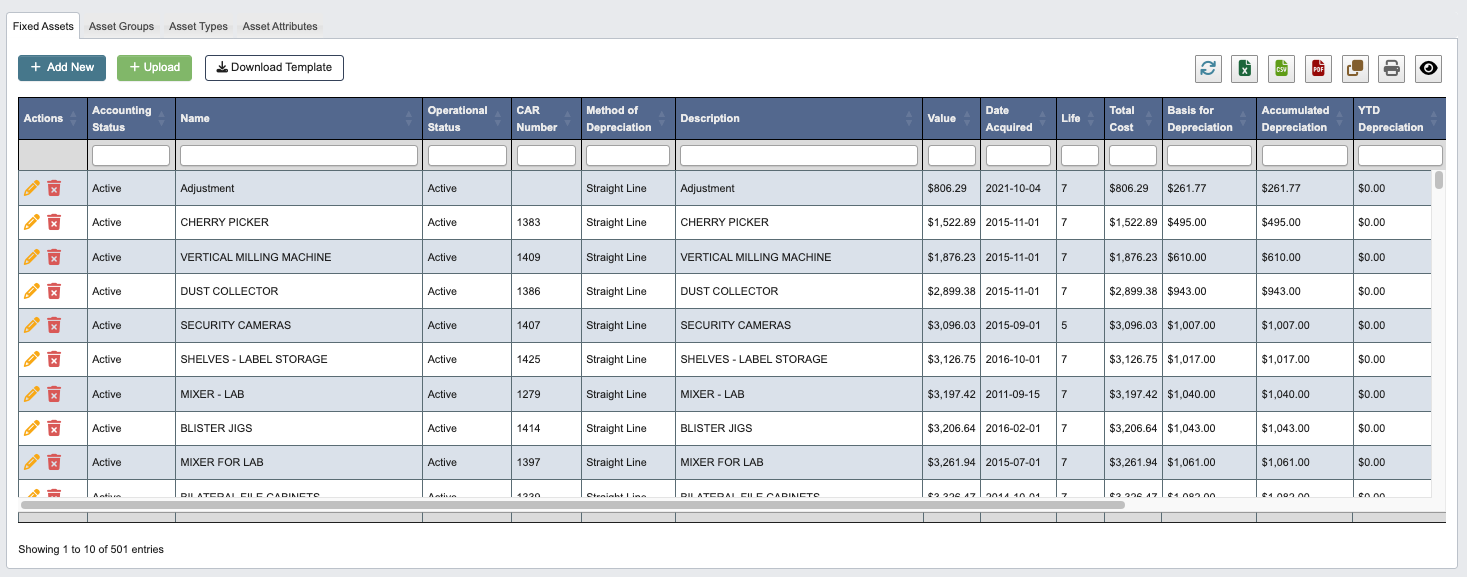

The Accounting → Fixed Assets submodule provides comprehensive tools for managing company assets, depreciation schedules, and asset lifecycle tracking within DASH. The system supports various depreciation methods and integrates with general ledger accounts for proper financial statement presentation. This submodule is used by accounting personnel, finance managers, operations staff, and auditors who need to track capital expenditures, manage asset depreciation, and maintain compliance with accounting standards and tax regulations. The Fixed Assets submodule provides several tabs for managing asset operations:- Fixed Assets: Record and manage individual assets with depreciation tracking.

- Asset Groups: Organize assets into logical groupings for reporting and management.

- Asset Types: Define categories of assets with specific characteristics.

- Asset Attributes: Configure custom attributes for detailed asset tracking.

Fixed Assets

- Click

+ Uploadto import multiple assets from a spreadsheet. - Click

Download Templateto get the proper format for bulk asset uploads.

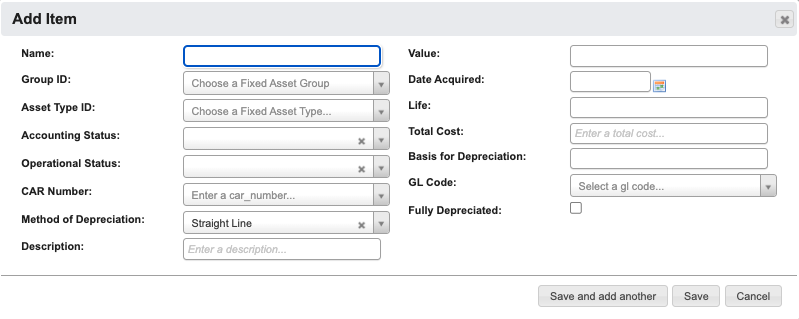

Adding New Assets

-

Click

+ Add Newto create a new fixed asset record.

-

Complete the asset information form with the following required and optional fields:

Name: Descriptive name for the asset.Group ID: Select the appropriate asset group for organizational purposes.Asset Type ID: Choose the asset type that defines the asset category.Accounting Status: Whether the asset accounting status is active or disposed.Operational Status: Whether the asset operational status is active or inactive.CAR Number: Enter the Capital Appropriation Request number.Method of Depreciation: Choose from available depreciation methods.Description: Detailed description of the asset.Value: Asset value.Date Acquired: Date when the asset was purchased or placed in service.Life: Expected useful life of the asset in years.Total Cost: Original acquisition cost including all setup expenses.Basis for Depreciation: Amount subject to depreciation.GL Code: General ledger account code for proper financial statement classification.Fully Depreciated: Checkbox to indicate if the asset is fully depreciated.

-

Choose your save option:

- Click

Save and add anotherto save the current asset and immediately create another. - Click

Saveto save the asset and return to the main list. - Click

Cancelto discard changes.

- Click

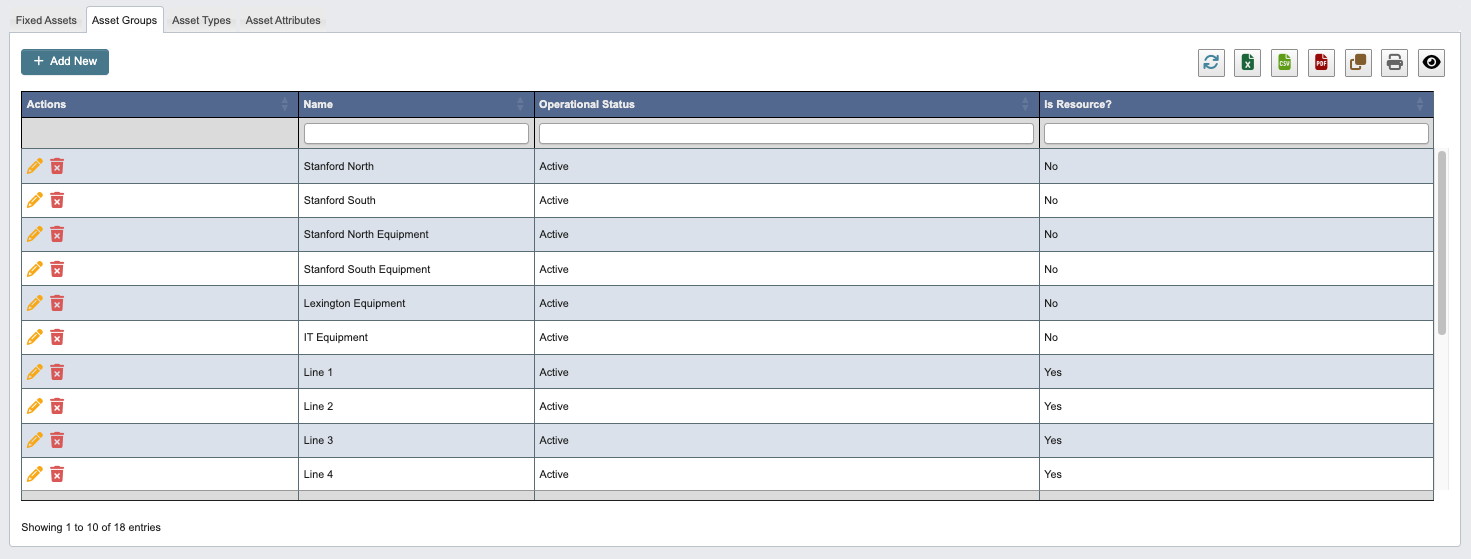

Asset Groups

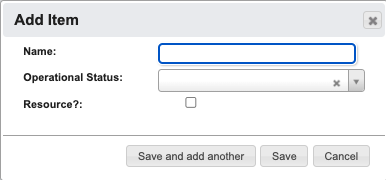

Creating New Asset Groups

- Click

+ Add Newto create a new asset group - Configure the group settings:

Name: Descriptive name for the asset group.Operational Status: Choose active or Inactive.Resource?: Indicate if assets in this group are considered operational resources.

- Choose your save option:

- Click

Save and add anotherto save the current group and create another. - Click

Saveto save the group and return to the main list. - Click

Cancelto discard changes.

- Click

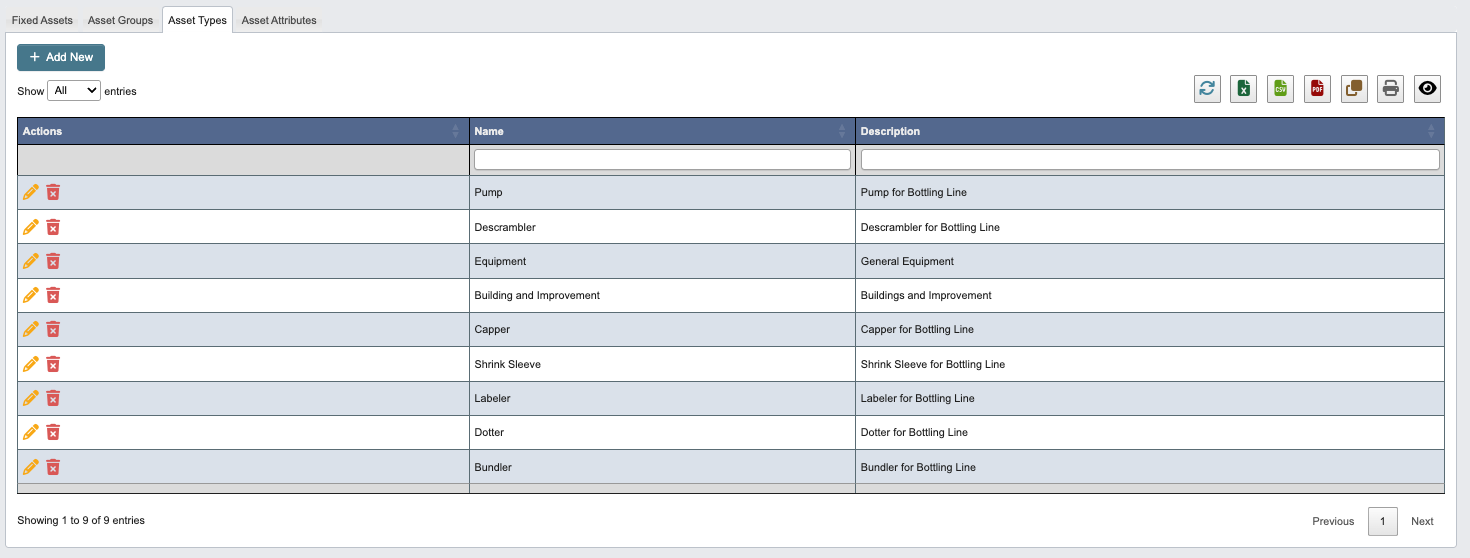

Asset Types

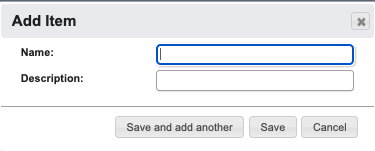

Creating New Asset Types

-

Click

+ Add Newto create a new asset type

-

Define the asset type:

Name: Asset type name.Description: Detailed description of what assets belong to this type.

-

Choose your save option:

- Click

Save and add anotherto save the current type and create another - Click

Saveto save the type and return to the main list - Click

Cancelto discard changes

- Click

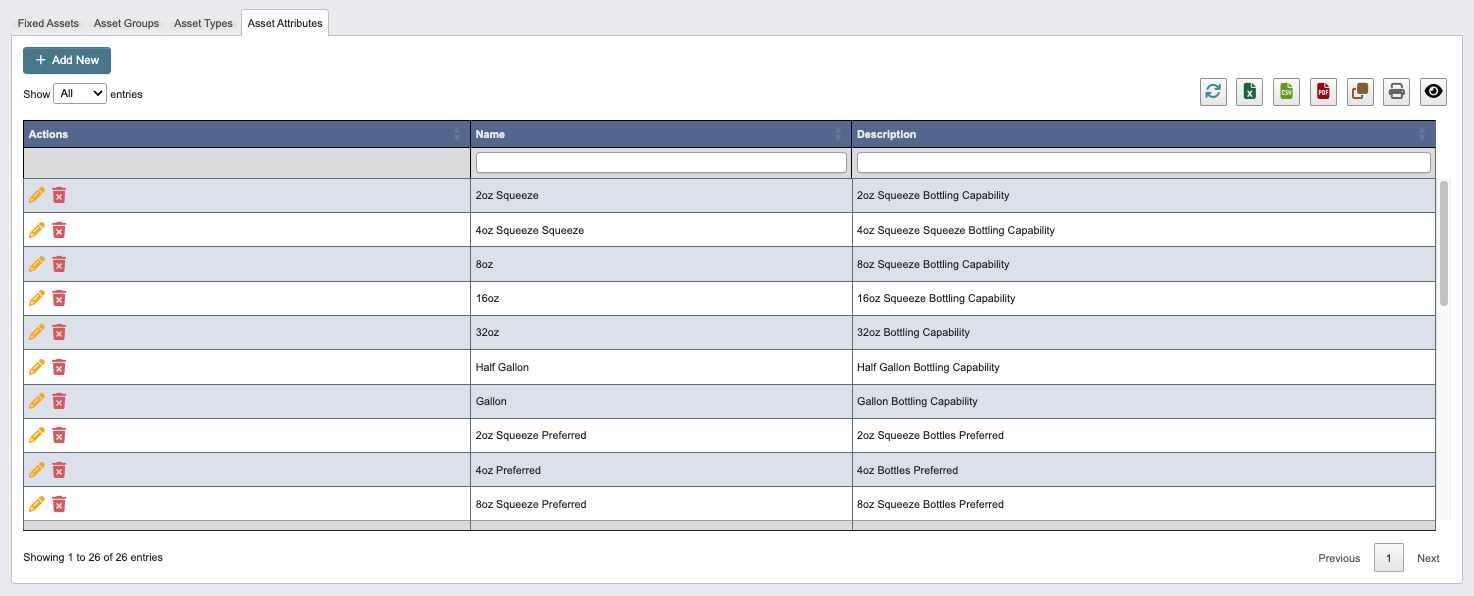

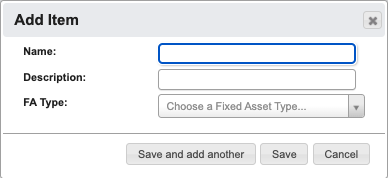

Asset Attributes

Creating New Asset Attributes

-

Click

+ Add Newto create a new asset attribute

-

Configure the attribute:

Name: Attribute name.Description: Explanation of what this attribute tracks.FA Type: Associate the attribute with specific fixed asset types.

-

Choose your save option:

- Click

Save and add anotherto save the current attribute and create another. - Click

Saveto save the attribute and return to the main list. - Click

Cancelto discard changes.

- Click